Customs Clearance Changes Low-Value Shipments

Dear Valued Customer,

In accordance with changes implemented by SARS (South African Revenue Service), on the importation of goods into the country, Aramex South Africa will now be adapting to the new regulations set forth.

As of immediate effect the low-value threshold for all clothing, textile, footwear and leather ecommerce shipments will fall away. Thus, all ecommerce shipments that contain such items will be required to undergo formal customs clearance and customs duty and VAT will be levied. These changes implemented by SARS come in response to general concerns expressed in recent months, over the importation of goods via ecommerce, where the low-value clearance process has previously been used.

This means that customers purchasing these items through ecommerce shopping platforms, anywhere in the world, which is classified as clothing, textiles, footwear and leather will now need to pay customs duty and VAT, regardless of the value of the items purchased.

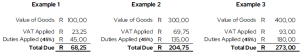

Below are some examples of what online shoppers can expect in terms of charges that will need to be paid to clear your shipment and deliver it.

*Excludes Aramex clearance and handling fees.

These charges must be paid by the customer in South Africa, before customs clearance can be completed, and the parcel be delivered. Payments will be accepted through our secure payment portal only, and no cash payments will be accepted.

The rate of duties will vary according to the specific product and is determined by SARS when the shipment is registered for clearance. For the aforementioned items (clothing, textiles, footwear and leather) the duty band ranges between 20% and 45%.

It must be stated that these changes to the low-value threshold is only applicable to ecommerce shipments containing the specific mentioned items. Other products such as electronics, toys, parts, for example, still fall under the R 500 low-value threshold. Any items with a value greater than R 500 will follow the normal process. Currently SARS is in the process of reviewing this and changes will likely be applied in early 2025.

We want to stress that these changes to the importation regulations in South Africa is not decided by Aramex South Africa. As a licensed cargo handling company, Aramex South Africa is bound by the laws of the country and must comply with the new regulations fully.

Aramex strives to ensure that we provide the best possible service to all customers within the legal parameters of what is set forth. We are constantly driving innovation and enhancements to the customer experience, and one such innovation is the clearance of cargo while in transit to South Africa. This process allows us to pre-clear your shipment by registering it electronically with SARS to obtain clearance before arrival in South Africa. The clearance is of course subject to meeting the requirements set out by SARS and will only be released by customs if all details of the shipment and the commercial invoice is in order.

The benefit to you as the customer is that your shipment is pre-cleared from customs and your duty and VAT charges can be paid through our secure payment portal, all before the shipment arrives in the country. This allows us to keep shipments moving as quickly as possible and speed up overall delivery times.

We thank you for your continued support.

Sincerely

Hein Bruyns

Communication & Customer Experience Executive

Aramex South Africa